Now is the time of year that clients expect changes to take place in the level and structure of their Accountant’s fees. According to Good Bad Ugly Insights, the average charge rate or fee increase for this year is 2.3%.

Our mission, however, is for you to get the most value out of your business, and your potential for increase is likely to be much more than just 2.3%. While you might expect clients to balk at a price rise, they may actually be highly motivated to invest more.

The current economic climate has made items like understanding cash flow and real-time business advice all the more critical for your clients, and they need help. You already have their financial information and their trust, who else is better prepared to help them!

The opportunity to grow your Accounting business through increased billings with existing clients is real. Here are our tips for getting clients wanting to pay more.

1. Stop Competing on Price

The entry of more and more low-end competitors into the industry is making compliance accounting a cheap commodity – don’t get sucked into a price matching vortex.

You are an expert, you have so much more to offer than basic compliance services.

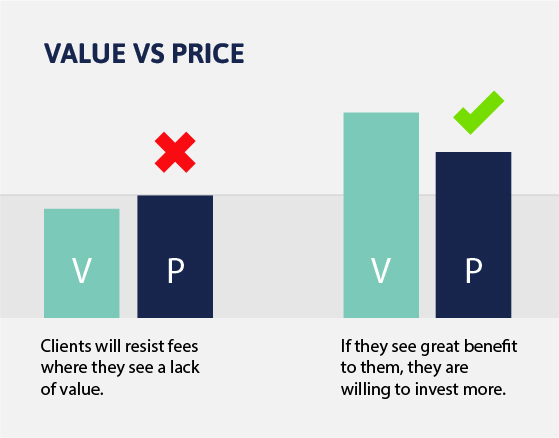

Warren Buffett famously said, “Price is what you pay; value is what you get.” We all know, people will happily invest in something if the value to them is greater than the price.

Value is the usefulness of an item to a customer, it could be measured in financial terms, emotional terms, physical conditions, or in any number of other ways.

While our work for clients is often viewed simply on the bottom line, we are also in a position to offer value in terms of saving them time, preventing bad decisions, and reducing their stress.

If a one-hour advisory meeting with you saves a client numerous sleepless nights, arguments with their partner, and a day’s work blundering through cash flow forecasting on their own, it is money well spent.

The key is to make your value vs price equation a deal that no one can refuse.

If value is perceived as low, then clients may resist an already low price, however, if they see a huge benefit to them, a higher price point is readily accepted.

2. Understand your value

The first step to offering clients more value might be recognising what you actually have to offer.

Reclaim your expertise. Do you or your staff have specialties? Do you excel in a particular niche or with a certain type of client? What makes you better than the practice down the road or the factory-farm accountants online? Identify key opportunities based on your specific expertise.

Do the work. Create an exhaustive list of high-end services and advisory activities your practice can facilitate. Also, identify all your high-value clients and time-wasters – don’t forget the clients who might be mid-range but actually need these services the most.

Ride the cloud. Technology developments and cloud-based accounting offer amazing opportunities for real-time analysis, comprehensive reports, and other insights, virtually at the touch of a button. Ensure your whole team knows their way around your software back to front, and make use of the power of the cloud.

3. Communicate your value

You might recognise your value, but your clients might not, here lies on of the biggest challenges to growing your Accounting business.

Don’t sell actions, sell results. Remember in all communications to talk about services from the perspective of how it benefits the client. Tell them that they will save time. Tell them that they will feel more confident in making business decisions. Tell them it will improve their life.

Update your website. Be sure your messaging is about your client’s needs and cuts straight to the point (we can help). Explain clearly how working with you benefits them. Demonstrate that you can offer expert advice on their points of frustration and save them time and stress.

Create resources. One of the best ways to demonstrate your expertise is to share them. Write (or have written for you) blog articles, tips or checklists that demonstrate your expertise in a way that is useful to your clients.

Email. Have you created a blog, resource, or new list of packaged services? Share them! Keep in regular email contact with clients offering them useful tips, information, and opportunities to review their level of service.

Be proactive. Save yourself time with phone inquiries and be helpful by emailing key information or useful tips to clients ahead of deadlines or important events.

4. Pricing and Packaging

Move beyond hourly rates. Charging by the hour really reduces your work to the lowest indicator of value, you’ve competing in the territory of cheap accountants everywhere. We recommend moving to a value based billing system where you are charging for the result you achieve for the client, not the hours spent.

This method makes results the focus of your business output. An invoice then becomes a tool for proving your value and quality of work and not just a thorn in your client’s side. It also makes invoices easier to evaluate from a client perspective, since they don’t know how many hours something should or shouldn’t take.

This change in pricing method is a great opportunity to move to an ongoing fixed-fee basis for your work. If there is one thing that clients have realised lately it’s the importance of predicting cashflow. Large bills for lodgements and JobKeeper submissions etc. come at a time now when there is likely to be cashflow pressure on the client.

Moving to an ongoing fixed fee basis will give your clients some short-term relief and prevents unexpected surprises. It also gives you predictable income and an ongoing client connection. Make things even simpler and more secure with direct debit payments: speed up payments and reduce debtor days.

Packaging is also a key part of communicating value. Explaining services clearly, as well as explaining the difference between services or packages helps clients understand your pricing as well as their service options.

It also clarifies expectations as clients can easily see what is in and out of scope. Clear packaging options make it easy to talk about service levels and reasons for an upgrade.

5. Capitalise on your value

This may be a multi-part process, by starting to build perceived value among clients before actually expecting them to pay up. Once clients start to see a change, start to have conversations about making your value work for them.

Upgrade clients. Start by putting a list together of your top 20 or 50 clients. Organise to meet them with a proposal that will result in them saving time, money & ensuring you know their financial situation inside-out (note this may involve a change in platform).

Every Email Counts. Each time you email clients be sure to include a segment at the bottom offering a little information about relevant resources or upgraded services that they might be interested in.

Offer a free review. When you contact clients throughout the year offer them a free half-hour review of their current services and prepare a quick proposal to discuss as mentioned above.

Referrals and new clients. Once your current clients are singing your praises, now is the time to ask for referrals and pursue new clients – the world is your oyster!

Changing fees is an important piece of the puzzle in getting the most out of your business and building a practice that you enjoy running. Good luck for the new financial year.

Want to grow your Accounting Business but don’t have time?

We can help you out at any stage of this process: articulating your value, exploring pricing and packages, upgrading your website messaging, creating quality blog articles and resources, email newsletters or targeting new clients.

Talk to us today about boosting business value, creating happy clients and increasing your practice billings.